Is 2026 a Good Time to Buy Real Estate? What Smart Investors Are Doing Right Now

- darnell66

- Jan 8

- 3 min read

If you follow the headlines, the 2026 real estate market sounds confusing at best—and risky at worst.

Some experts say prices are still too high.Others claim interest rates will drop “any month now.”Meanwhile, social media is still full of people promising easy passive income.

So let’s ask the question buyers and investors are actually searching for:

Is 2026 a good time to buy real estate—or is it the worst time in years?

As someone actively investing, building, and structuring deals, here’s the honest answer:

2026 is not a timing market. It’s a strategy market.

And the investors who understand that are the ones still buying with confidence.

Why “Is It a Good Time to Buy Real Estate?” Is the Wrong Question

Most people ask whether it’s a good time to buy real estate in general.

Experienced investors ask:

Does this deal cash flow in today’s market?

Can it survive high interest rates?

What happens if rents or timelines don’t go as planned?

In the 2026 real estate market, success isn’t about optimism—it’s about fundamentals.

Great deals are built on:

Conservative underwriting

Realistic expense assumptions

Strong execution and margin

Every market creates opportunity. The rules just change.

What’s Actually Happening in the 2026 Real Estate Market

1. High Interest Rates Changed Real Estate Investing

Higher interest rates didn’t kill real estate investing in 2026—they exposed weak deals.

What disappeared:

Speculative buyers

Overleveraged investors

Deals that only worked with cheap money

What remains:

Less competition

More motivated sellers

Stronger negotiating leverage for prepared buyers

For disciplined investors, high interest rates create opportunity, not paralysis.

2. Sellers Are More Negotiable in 2026

Unlike the peak years of 2021–2022, sellers no longer control every deal.

Today’s real estate market favors buyers who know how to structure offers:

Price reductions

Seller credits

Interest rate buy-downs

Flexible closing timelines

In 2026, deal terms matter just as much as purchase price.

3. Waiting for Rates to Drop Is a Risky Strategy

Many buyers are waiting on the sidelines, asking:

“Should I wait until interest rates come down before buying real estate?”

The problem? When rates fall, prices and competition typically rise.

Smart investors understand:

You can refinance rates later

You can’t refinance your purchase price

The best deals happen when fewer people are buying

What Smart Real Estate Investors Are Doing in 2026

1. Buying Based on Cash Flow, Not Appreciation

Real estate investing in 2026 is about performance today, not hope tomorrow.

Smart investors assume:

Slower rent growth

Higher insurance and maintenance costs

Conservative exit values

If the numbers don’t work now, the deal doesn’t happen.

2. Focusing on Proven Asset Classes

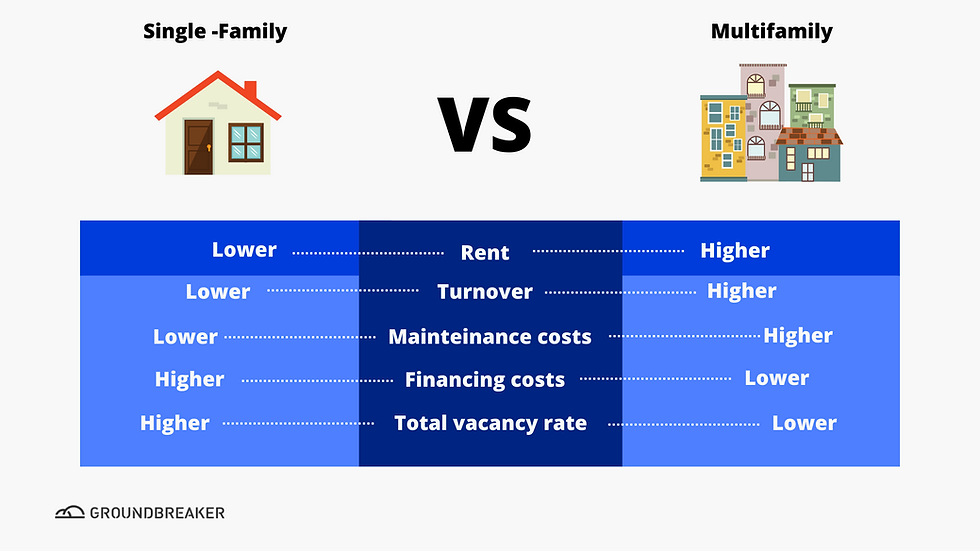

Instead of chasing trends, experienced investors are targeting:

Small multifamily properties (2–4 units)

Workforce housing

Value-add rental properties

Fix-and-flip deals with real margin

These assets perform across market cycles because demand never disappears.

3. Using Creative Deal Structures

The best real estate investment strategies in 2026 focus on structure, not leverage.

We’re seeing investors:

Partner with private capital

Use seller financing when available

Enter joint ventures to reduce risk

Share expertise instead of over-borrowing

In today’s market, how you buy matters as much as what you buy.

4. Thinking Long-Term, Not Timing the Market

Trying to perfectly time the real estate market rarely works.

Smart investors focus on:

Time in the market

Assets that survive multiple cycles

Multiple exit strategies

They ask:

“If this takes longer or costs more, does the deal still work?”

If the answer is yes, they move forward.

So, Should You Buy Real Estate in 2026?

Here’s the clear answer:

2026 is a bad time to buy real estate if you:

Rely on appreciation to make deals work

Can’t handle short-term volatility

Ignore operating costs and risk

2026 is a great time to buy real estate if you:

Buy with margin and discipline

Understand today’s financing environment

Focus on long-term cash-flowing assets

Structure deals intelligently

This market rewards patience, preparation, and experience—not hype.

Final Thoughts on the 2026 Real Estate Market

The best real estate opportunities rarely appear when everyone feels confident.

They show up when:

Uncertainty keeps others frozen

Headlines are negative

Competition fades

That’s exactly what the 2026 real estate market looks like.

At The Laureless, we focus on:

Buying with clarity

Structuring smart partnerships

Building long-term real estate businesses

If you’re exploring real estate investing in 2026—whether as an owner, partner, or investor—the opportunity is still here.

It just requires a smarter approach.

Comments